Debanking Cancel Culture

It sounds so Orwellian. Banks denying service to people with certain beliefs. Not in America, right?

I read about “de-banking” this past week. I’m sharing what I’ve learned.

Kanye West

I vaguely recall Kanye was kicked out of a bank sometime last year. Admittedly, I don’t listen to his music, so like everyone else, I scroll past things that don’t affect me.

This was the tweet I saw.

Earlier today I learned that @kanyewest was officially kicked out of JP Morgan Chase bank. I was told there was no official reason given, but they sent this letter as well to confirm that he has until late November to find another place for the Yeezy empire to bank. pic.twitter.com/FUskokb6fP

— Candace Owens (@RealCandaceO) October 12, 2022

Is De-Banking Really Happening?

Yes, it is. I’ve compiled them.

Nigel Farage

In June 2023, Nigel Farage claimed Coutts de-banked him for his political beliefs.

Nigel is the former UKIP and Brexit leader. Coutts Bank said he didn’t have enough money. Nigel then went and obtained a 40-page document to support his allegation he was debanked due to politics.

In the document, bank cited a retweet of a Ricky Gervais joke and his friendship with Novak Djokovic to raise concerns he was ‘xenophobic and racist’. Document also referenced his friendship with Donald Trump. Finally, document states ‘at best’ seen as ‘xenophobic and pandering to racists, and at worst, he is seen as xenophobic and racist’. ‘He is considered by many to be a disingenuous grifter,’ it adds. Read more.

Nigel has staretd a website to lobby against banks debanking. It’s called accountclosed.org

The establishment are trying to force me out of the UK by closing my bank accounts.

I have been given no explanation or recourse as to why this is happening to me.

This is serious political persecution at the very highest level of our system.

If they can do it to me, they… pic.twitter.com/O4xQ1h79ub

— Nigel Farage (@Nigel_Farage) June 29, 2023

Freedom Convoy

Think it only happens to the rich? Nope.

In February 2022, truckers who participated in Freedom Convoy (protests against COVID-19 vaccines), were punished by Justin Trudeau. Using the Emergencies Act, Trudeau partnerd with banks to “de-bank” with Freedom Convoy protesters.

Freedom Convoy truckers and associates are middle-class working citizens.

One trucker said ALL his bank accounts were shut down, accounts unrelated to trucking, politics, or COVID.

The truckers also had $10 million in GoFundMe funds blocked.

Even Donors To the Cause Got Debanked

“Just to be clear, a financial contribution either through a crowdsourced platform or directly, could result in their bank account being frozen?” Conservative MP Philip Lawrence asked Department of Finance Assistant Deputy Minister Isabelle Jacques.

“Yes,” she replied.

“They didn’t have to actively be involved in the protest, they didn’t have to be here in Ottawa at one of the blockades?” Lawrence asked.

“No, not themselves,” she replied.

“It could be indirectly.”

Police ordered a freeze on more than 206 accounts, she said, adding some entities or individuals had more than one account locked.

“The de-banking provisions are so broad, that literally a clerk at a Kwik-E-Mart who sold a propane canister to a protester could have his accounts frozen.”

Indigenous Advanced Ministries — a Memphis, Tennessee-based nonprofit

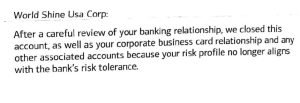

In April 2023, for no reason Indigenous Advanced Ministries received closure letters from Bank of America. According to Bank of America, their “risk profile no longer aligns with the bank’s risk tolerance”.

Indigenous Advanced Ministries is a Christian nonprofit organization helping orphans in Uganda. They are located in Memphis, Tennesee. They are pro-life and believe marriage is between a man and a woman.

Their attorneys, Alliance Defending Freedom (ADF), has filed a complaint with the Tennessee Attorney General. It’s unclear right now whether TN will open an investigation, but ADF attorney Jeremy Tedesco said Bank of America and other large banks are leveraging their own “risk tolerance” policies in order to “box out disfavored but legal business operations.”

The practice, said Tedesco, started during the Obama administration under “Operation Chokepoint,” which sought to eliminate fraud in the U.S. banking system but was criticized by Republicans and other industry advocates before it was shut down in 2017 under the Trump DOJ.

Tedesco said Operation Chokepoint used reputational risk as a “tool to get the federal regulators to push banks to push certain industries out of banking privileges and access to services” and may have opened the door to further “de-bank” Christians, conservatives and other aligned groups which “hold certain views the progressive Left doesn’t like.

“So now it’s reputationally risky to serve Christian or other organizations that the Left disagrees with,” he added.

Operation Choke Point

For those that are unfamiliar, Operation Choke Point was a coordinated effort between the Department of Justice (DOJ), Federal Deposit Insurance Corporation (FDIC), and Office of the Comptroller of the Currency (OCC) to shut down politically controversial businesses by restricting their access to banks. As one official described it, the operation was designed to “[choke] them off from the very air they need to survive.”

Mike Lindell

In February 2022, Minnesota Bank and Trust terminated Mike Lindell, President and CEO of MyPillow’s bank accounts, citing that he was a “reputation risk” for the company. Apparently they disagreed with his politics.

According to Business Insider, Republican AGs from 19 states Accuse Chase of DeBanking

Republican attorneys general from 19 states have accused JPMorgan Chase of closing accounts and discriminating against customers due to their political or religious beliefs.

In this letter sent to JP Morgan CEO, Republicans representing 19 states said the bank had canceled major organizations’ checking accounts and had asked screening questions focused on religion and politics before reinstating them.

The attorneys general said JPMorgan “abruptly closed” the checking account of the National Committee for Religious Freedom (NCRF), a non-profit, before a letter informing it about the decision had been delivered.

Notice a Pattern Here?

It appears that all these people share this one thing in common: their beliefs are not the prevailing culturally accepted ones. I guess you can label them “conservative”, or “right-leaning.”

If there are any examples of liberal or “left-leaning” people being debanked, please comment and let me know – I’ll be sure to include them!

Recent Comments